Charting the Future: Preparing for a Decade of Small Business Shifts in Canada

Author: Gord McFarlane

Succession planning is vital for a smooth transfer of business assets, benefiting the owners, the business, and Canada’s economy. With Canada’s aging population and the retirement of baby boomers, this has become increasingly important. Poorly managed transitions can lead to undervalued sales, closures, job losses, and economic instability. This month, FYinsights outlines the importance of succession planning and provides tips to help small and medium-sized businesses prepare for a successful exit.

Over the next decade, more than $2 trillion in business assets are expected to change hands, marking the start of the largest transition in Canadian small business ownership in history. With aging baby boomers leading this shift, approximately 76% of small business owners plan to exit their businesses in the next 10 years—that’s three out of four businesses. This unprecedented change is unlikely to happen again. As this transformation accelerates, it’s crucial for business owners to prepare now or risk being left behind in a rapidly evolving buyer’s market.

Source: Canadian Federation of Independent Business, “Succession Tsunami – Preparing for a decade of small business transitions in Canada”, https://www.cfib-fcei.ca/en/research-economic-analysis/succession-tsunami-preparing-for-a-decade-of-small-business-transitions, January 2023.

Retirement is the leading reason for small business transitions.

Yet, surprisingly, only 1 in 10 small business owners have a formal succession plan in place.

Addressing these obstacles is key to ensuring a smooth and successful transition of your professional practice.

Start Planning Early and be Adaptable as Different Scenarios Unfold

Optometry practices, like other professional practices, are commonly sold to partners or associates, larger group practices such as FYidoctors, or consolidators. A well-crafted succession plan should consider all potential pathways to ensure the owner’s goals are fully realized. Larger group practices often offer the highest value during a transition by leveraging operational synergies, providing ongoing compensation to selling doctors who wish to remain involved, and offering equity upside opportunities that can be structured to defer income taxes as part of a well-developed strategic plan.

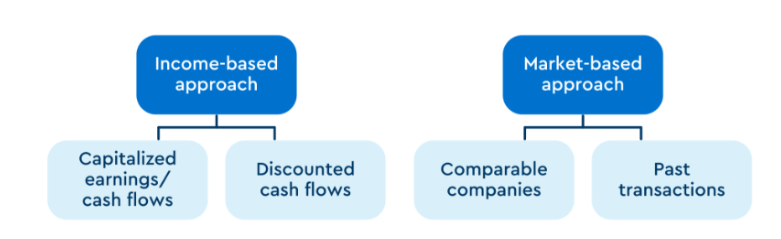

Determine the Value of Your Practice Using an Income or Market-Based Approach

An income-based approach values a practice based on normalized earnings or cash flow, adjusting for non-recurring expenses and future doctor compensation. This cash flow is either capitalized (historical performance) or discounted (future projections), with rates reflecting the risk of achieving future cash flow. For instance, a 20% capitalization rate equals a 5X multiple.

Market-based approaches require obtaining information on comparable companies and past transactions to determine the implied multiple of earnings before interest, taxes, depreciation, and amortization (“EBITDA”). However, the difficulty in obtaining relevant and comparable information can lead to inaccurate valuations. Professional business valuators, however, tend to use market-based approaches to test their conclusions using an income-based approach.

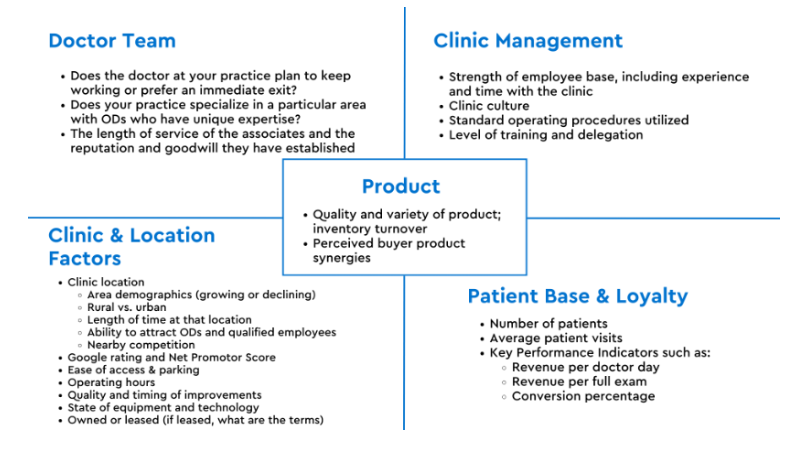

Conduct a Self-Assessment of Your Practice

As previously mentioned, a potential buyer will want to evaluate the risk associated with achieving your practice’s cash flows. As part of your succession planning, it’s wise to assess the qualitative factors buyers typically consider when evaluating a practice. This will help you identify and address any perceived weaknesses, making your practice more attractive and reducing potential concerns.

Determine What is Being Sold

When selling your practice, consider after-tax proceeds and whether to sell shares or business assets, as tax implications differ. Selling shares may qualify for the Lifetime Capital Gains Exemption (LCGE), allowing up to $1.25 million in tax-free gains in 2025 if conditions are met. Advanced planning is key, as the exemption’s future is uncertain. Tax benefits, time value of money, and reduced risk often favour selling sooner. For instance, under the FYidoctors model, a vendor who sold shares today for $2 million and utilized the LCGE would be $1.1 million better off than if sold 8 years later, assuming a 6% reinvestment rate. This example includes continued compensation for the selling OD.

Reduce Reliance on a Single Optometrist

To reduce reliance on a single optometrist, focus on transitioning personal goodwill into commercial or saleable goodwill. This involves building strong brand recognition, standardizing patient care protocols, and fostering a team approach that encourages patients to see the practice, not just the individual. By emphasizing the value of the business itself—such as its reputation, systems, and team—rather than the personal relationships of a single provider, the practice becomes more scalable, sustainable, and attractive to potential buyers.

Monitor and Assess Your Succession Plan

In today’s dynamic economy, it’s crucial to monitor KPIs and address areas of perceived risk in your business. Despite the benefits of succession planning, fewer than 10% of Canadian small business owners have a formal plan. Professionals such as CPAs, Chartered Business Valuators, lawyers, and succession experts can provide valuable guidance.