Planning for 20/15 Vision: A Clearer Budget

Do you want to receive more insightful reads from our thought leadership series?

Subscribe here!

Hello,

Budget season is approaching. For many optometry practices, it’s a task that can feel like a chore: spreadsheets, projections, line items, and assumptions that may or may not hold true. But a well-designed budget isn’t just paperwork — it’s the foundation for strategic decision-making, a roadmap that guides your clinic through uncertainty, growth opportunities, and the realities of today’s evolving healthcare landscape.

In this article, prepared by FYihealth group’s Corporate Development Director, Justin Newell, we’ll break down how to build a budget for 2026 that isn’t just about controlling costs, but about setting your practice up for success.

Why a Budget Matters More Than Ever

Optometry practices in Canada face unique challenges going into 2026:

- Rising patient demand due to an aging population and increasing rates of childhood myopia.

- Labour pressures with staff shortages and higher wage expectations.

- Inflationary costs that affect everything from frames and lenses to rent and utilities.

- Technology shifts like advanced diagnostic tools, AI-based screening, and tele-optometry.

- Changing patient expectations — today’s patients expect efficiency, convenience, and personalized care.

A budget allows you to proactively manage these forces. Instead of reacting month by month, you can align your financial resources with your long-term goals and create clarity for your team.

Step 1: Review Your Historical Performance

Start by looking back at 2024 and 2025:

- How did your revenue track against your expectations?

- Which expenses grew faster than anticipated?

- Did you meet your targets for patient volume and retention?

Pulling 2–3 years of financials side by side helps identify patterns. For example:

- Do you consistently see a dip in appointments during July and August?

- Have staffing costs been creeping up 1–2% per year beyond inflation?

- Is your capture rate in optical flat or declining despite steady exam growth?

This historical view gives you the baseline from which to forecast 2026.

Step 2: Forecast Patient Volume and Revenue

Revenue begins with patient visits. Here’s how to approach it:

- Estimate exam volume. Consider historical averages, recall system effectiveness, and whether you plan to increase doctor days in 2026.

- Break it down by patient type. Adults, children, seniors, contact lens patients, medical exams. Different categories have different fee schedules and product implications.

- Layer in capture assumptions. If 70% of patients buy glasses in-house, model what happens if you can improve that to 75%. A small percentage change here has a big impact on revenue.

For many clinics, a realistic forecast might be modest growth of 3–5% in exam volume — but paired with targeted initiatives in optical capture or specialty services, that growth could be significantly higher.

Step 3: Understand Staffing Costs

Staffing is a large expense category, often 20–25% of total revenue. As you budget for 2026:

- Factor in expected wage increases. Many clinics will need to budget 4–6% higher wages just to remain competitive.

- Consider whether staff mix is optimized. Could you delegate more pretesting, case history, or optical tasks to reduce bottlenecks? One useful approach is maintaining more part-time staff (e.g., two PT employees instead of one FT) to provide flexibility in hours and adjust more easily to monthly fluctuations in doctor days.

- Account for training and retention initiatives. Investing in your team reduces turnover and strengthens patient care.

A best practice is to build scenarios: one where staffing hours remain constant, and one where additional hours (or new hires) are added. This shows the trade-offs between cost and patient volume growth.

A critical budgeting insight is that revenues and costs should move together where possible. For example, if optometrists vacation days reduce exam volume in a given month, staffing hours (and other variable costs) should be adjusted accordingly. Aligning expenses with anticipated revenue ensures the practice doesn’t carry unnecessary costs during slower periods.

Step 4: Plan for Operating Expenses

Beyond staffing, most practices face predictable expense categories:

- Occupancy costs: rent, utilities, maintenance.

- Supplies: contact lenses, frames, diagnostic materials.

- Technology: EMR systems, diagnostic equipment leases, IT support.

- Marketing: recall campaigns, digital ads, community outreach.

It’s important to distinguish between fixed costs (expenses that remain largely the same regardless of patient volume, such as rent or software subscriptions) and variable costs (expenses that rise and fall with activity levels, like contact lens purchases or lab fees). This distinction helps clinics anticipate how expenses will scale as revenue grows—or contract if patient volumes decline.

For 2026, consider the impact of inflation. A 2–3% cost increase across all categories may not sound like much, but on a $500k expense base, that’s $10,000–$15,000 you’ll need to budget for.

Step 5: Allocate for Growth Investments

Too often, budgets focus only on cost control. But true financial planning should create room for growth:

- New diagnostic equipment (e.g., OCT, Optomap).

- Clinic renovations to improve patient flow.

- Marketing campaigns to attract new patients.

- Adding a new associate optometrist to expand clinic capacity.

Building these investments into your budget ensures they don’t get pushed aside when “urgent” expenses arise.

Step 6: Build a Cash Flow Forecast

Revenue and expense budgets tell part of the story. Cash flow tells you if you’ll actually have money in the bank to pay bills. In 2026, rising interest rates and tighter credit mean that lenders and landlords are looking closely at cash reserves.

- Forecast monthly inflows (exam fees, product sales, third-party payments).

- Forecast monthly outflows (payroll, rent, supplier invoices, loan repayments).

- Identify months where cash is tight and plan accordingly.

Some practices set a goal of maintaining at least two months of expenses in reserve to absorb unexpected shocks.

Contingency & Emergency Fund: Go one step further by adding a 2–3% contingency line in your budget. This protects against unplanned repairs, supply chain delays, or sudden staff absences — costs that can otherwise throw off your financial plan.

Step 7: Build “What If” Scenarios

The future rarely plays out exactly as planned. That’s why scenario planning is crucial:

- Base case: modest growth, steady costs.

- Upside case: higher capture rate, new associate added.

- Downside case: lower patient volume, higher wage pressure.

By building these models, you’ll know in advance what levers you can pull — such as delaying equipment purchases or adjusting marketing spend — if conditions change.

Step 8: Engage Your Team

A budget isn’t just for owners or accountants. It’s a tool to align the entire team:

- Share key targets (exam volume, optical sales goals, capture rate).

- Explain why certain investments are being made.

- Celebrate when actual results exceed budget.

When the team understands the “why” behind the numbers, they’re more likely to buy in and help execute.

Tax Planning & Owner Compensation

Independent practices often overlook the tax impact of owner compensation and capital spending. Decisions about whether to take dividends or salary, when to make equipment purchases, or how much to set aside for corporate tax installments can materially change your bottom line.

Tip: Work with your accountant to align your budget with tax planning. For example, timing a major equipment purchase in December versus January could shift your tax liability in meaningful ways.

KPIs & Benchmarks

Budgets should not exist in a vacuum. Compare your numbers against both industry standards and your own internal metrics.

Key benchmarks to consider:

- $ per Doctor Day (DD): Are you getting the most from each day your doctors are in clinic?

- Wage Ratio: Is payroll staying in line with revenue growth, or creeping up over time?

- Capture Rate: Are exam volumes translating into eyewear and contact lens sales?

By reviewing these regularly, you’ll spot trends early and adjust your budget to stay competitive.

Succession & Long-Term Planning

For independent owners nearing retirement or considering expansion, the 2026 budget is also an opportunity to think big picture.

Ask yourself:

- Does this budget support adding a partner in the next few years?

- Am I preparing financially for a transition or eventual sale?

- What investments today will increase the long-term value of my practice?

Building succession into your budget ensures you’re planning not only for next year, but for the next chapter of your career.

Practical Tips for 2026

- Leverage data. Use your EMR and POS systems to track key metrics monthly against budget.

- Think in percentages, not just dollars. If payroll is 21% of revenue this year, what happens if revenue grows but payroll grows faster?

- Plan for technology adoption. AI-driven tools and tele-optometry will continue to evolve — don’t ignore them in your planning.

- Protect against inflation. Build a cushion for rising supplier costs and insurance premiums.

- Don’t skip marketing. In slower economic times, the practices that continue to invest in patient communication tend to come out ahead.

The Bottom Line

A well-constructed budget isn’t just a financial document — it’s a strategic tool that helps you navigate uncertainty, seize opportunities, and build a stronger practice.

As you prepare your 2026 budget, take the time to look beyond the numbers. Ask yourself:

- Where do I want my practice to be in three years?

- What investments will help me get there?

- How can my budget reflect not just costs, but opportunities?

When approached thoughtfully, your budget becomes more than an annual exercise — it becomes a roadmap for sustainable growth and continued excellence in patient care.

If you’d like access to our Excel budget template, please email us your phone number at corporatedevelopment@fyidoctors.com, and we’ll send the template directly to you.

Join Our Webinar

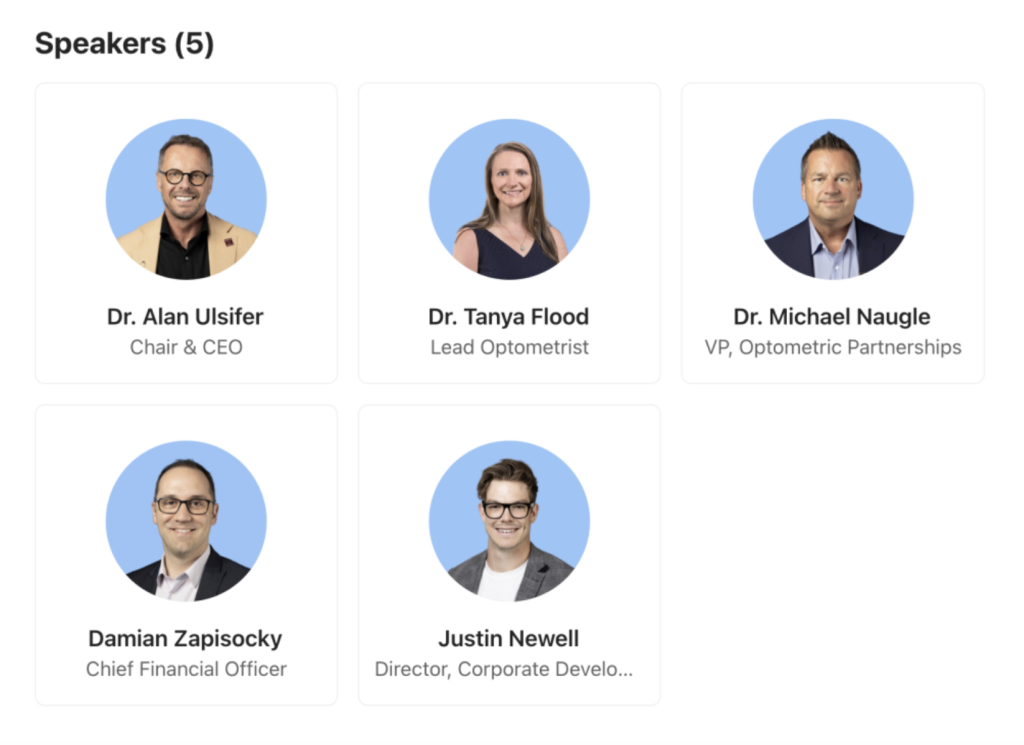

Join us for an exclusive webinar designed for Optometrists interested in exploring partnership opportunities with FYidoctors. Hear directly from industry professionals Dr. Alan Ulsifer, Dr. Tanya Flood, Dr. Michael Naugle, Damian Zapisocky, and Justin Newell as they share insights and expertise to all things FYidoctors.

What you’ll learn:

✅ Explore the possibilities in partnering with FYi

✅ Understand The FYi Advantage: our strategy, operations, and vision

✅ Hear why so many Optometrists and patients choose FYi

✅ Walk through the valuation process and gain insight into how practices are valued

Event Details:

📅 Date: Tuesday, October 14, 2025

🕕 Time: 8:00 PM EST (6:00 PM MST ; 5:00 PM PST)

⏱️ Duration: 1 hour, including question period (Online event)

Note: Participant videos and names will not be displayed.

Interested in this event? Register here

About Us

We are doctor-led and professionally managed; our doctors are majority owners in our business. That means major decisions about patient care, your team members, and your practice are discussed with the right level of support across the organization. We’re proud to be a true collaborative partner. From input on every level of the organization to a real stake in our growth and success, we work better because we work together.

We welcome both you and your practice.

Interested in talking with us? Contact us today!